India is one of the key Defence markets driven by increasing Defence spend, military modernization plans, and strong engineering base. India's capital expenditure for Defence procurement is expected to be around INR 15,00,000-18,00,000 crore (USD200-250 billion) over the next 10 years and 'Make in India' has been the government cornerstone to promote indigenous Defence production in the country.

Given the increasing focus on self-reliance, the Ministry of Defence (MoD), has set a target of doubling the Defence production to INR 180,0000 crore (USD25 billion) by 2025.The current indigenous Defence production is estimated to reach INR90,000 crore (USD12.5 billion) in 2019-20 and in order to achieve the targeted annual growth rate of ~15 percent the MoD is focusing on boosting Defence exports.

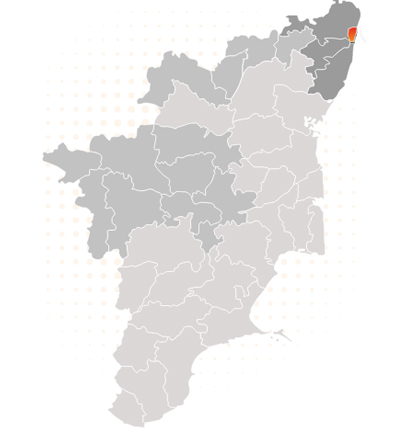

Defence Corridor

Defence Corridor

Self Reliance

- In search of greater self-reliance and with the objective of building India into a global manufacturing hub, the Make in India initiative was launched in 2014.

- This covers 25 sectors (of which Defence is one) and aspires to increase the manufacturing GDP to 25 percent from the present 16 per cent - as well as to create 100 million jobs by 2022.

- At the same time, since 2014 the Government has undertaken a number of reforms related to the Defence industry, including: industrial licensing; increasing the FDI cap to 79 percent; a new export strategy; and detailed standard operating procedures (SOPs) for granting no objection certificate (NOC) to the industry for certain Defence exports.

- The draft Defence Acquisition Procedure (DAP)2020 by the MoD is a further step towards widening private sector participation in this vital part of the economy and advancing Make in India.

Highlights

Why Tamil Nadu Defence Industrial Corridor?

Investor friendly Aerospace & Defence policy with numerous fiscal and related incentives

Corridor to emerge as sourcing base for Defence Products and Services

TNDIC offers greater multiplier factor for Offsets obligation

Five Nodes of TNDIC have mature ecosystem to support the Aerospace & Defence industry

Common facilities and Test Centres for assisting companies in Testing and Prototyping products

Tamil Nadu government may be a co-investor for Anchor Projects in the corridor

Corridor Objectives

Promote Indigenisation and support 'Make in India' initiative towards fulfilling equipment requirement worth over USD 250 Billion by 2025.

Promote ancillarisation and development of MSMEs for Aerospace and Defence manufacturing in each of the 5 nodes within the state of Tamil Nadu.

Facilitate incorporation of MSMEs into the global supply chain as well as the supply chain of DPSUs / Indian primes.

Encourage skill development and create jobs within the state by meeting skill / education standards espoused by the A&D sector globally.

Provide adequate trunk infrastructure towards making Tamil Nadu the preferred destination for A&D manufacturing for OEMs (Strategic Program).

Transform armed service requirements to drive the economic growth of state.

Capture indigenisation requirements from DPUs and OFBs towards supporting defence manufacturing infrastructure.

Provide a platform for ploughing offsets obligations of OEMs into the state for its development.

Defence Acquisition Procedure (DAP) 2020

With the release of the draft Defence Acquisition Procedure (DAP), 2020 Ministry of Defence (MoD) aims to develop India as a ‘Global Defence Manufacturing Hub’. The draft procurement policy builds on the Government’s approach to boost indigenous capability. These changes in the DPP 2020 can be classified under the following categories

The new procurement category of leasing has been introduced for acquisition under sub- categories namely Lease (Indian) & Lease (Global).

The D&D and the SPM categories have been added to give boost to indigenous manufacturing and R&D in defence sector.

For offset obligations – A multiplier factor of two is permitted for investments made in the Defence Industrial Corridors

The Buy (Global - Manufacture in India) category defines procurement of equipment from global OEMs with Indigenous Content. This can be achieved by the manufacturing of entire equipment or MRO facility.

Tamilnadu Aerospace & Defence Industry

With a strong industrial base Tamilnadu has offered itself as a choice destination for a number of Defence PSUs and private industries to operate out of Tamil Nadu. The state has made significant contribution in terms of R&D, skill development and manufacturing for the sector by developing large institutions that are dedicated to this sector growth. The development of the Aerospace and Defence sector is one of the focus areas for the Tamilnadu government which has promoted the industry with number of incentives and development of aerospace and Defence Parks in various districts of the state.

The state has both Public and private industries that have created the ecosystem that will be enhanced as part of the Tamil Nadu Defence Industrial corridor. The Armoured Vehicles and Ammunition Depot of India popularly known as AVADI is a large defence industrial area and also encompasses CVRDE , the DRDO arm spearheading the design and development of combat vehicles for the Defence forces.

The state has over the decades encouraged many industries to evolve into TIER I and TIER II suppliers to many of the OEMS in the Aerospace & Defence Sectors. The Government of Tamil Nadu was one of the first states to issue the Policy for Aerospace & Defence Industries

The state has both Public and private industries that have created the ecosystem that will be enhanced as part of the Tamil Nadu Defence Industrial corridor. The Armoured Vehicles and Ammunition Depot of India popularly known as AVADI is a large defence industrial area and also encompasses CVRDE , the DRDO arm spearheading the design and development of combat vehicles for the Defence forces.

The state has over the decades encouraged many industries to evolve into TIER I and TIER II suppliers to many of the OEMS in the Aerospace & Defence Sectors. The Government of Tamil Nadu was one of the first states to issue the Policy for Aerospace & Defence Industries

| Capability | Companies |

|---|---|

| Aircraft / Helicopter Structural Parts | LMW, L&T, SunFab |

| Aircraft/Spacecraft / Gas Turbine Engine Parts | LMW, JK Fenner, Natesans, Metallic Bellows, Rane, Sundram Fasteners, UCALTechnologies, Z-Forge, SunFab |

| Aircraft Parts, Equipment, Interiors | Aerospace Engineers, Data Patterns, LMW, MEL Systems, Metallic Bellows, Sundram Fasteners |

| Anti Vibration Systems | Aerospace Engineers, JK Fenner, Metallic Bellows |

| Armoured Vehicles | HVF, AVANI |

| Batteries – Lead Acid / Li-ion | dESPAT, High Energy Batteries, TUNGA |

| Composite Manufacturing | Fabheads, Indocool, LMW, ST Advanced, UCAL Technologies |

| Defence Electronics | BEL |

| Engineering Services | Aeolus, Data Patterns, MEL Systems |

| Flight Control / Navigation / CommunicationSystems | Data Patterns, Elektronik Lab |

| Missiles | L & T MBDA |

| MRO components and spares | Aerospace Engineers, MEL Systems, Metallic Bellows, Qmax, TUNGA |

| Satellite / Launch Vehicle Equipment | Aerospace Engineers, Bhastrik, Data Patterns, SunFab, Sundram Fasteners |

| Satellite | Agnikul |

| Ship Building | L & T Shipyard |

| Simulators | MEL Systems, Lucas, TVS |

| Surveillance Systems / Aviation SW | Data Patterns, Elektronik Lab |

| SW Systems | Data Patterns, Lucid SW, MEL Systems |

| UAV Design and Manufacturing | Fabheads, LMW, Indocool, Tunga, UCAL Technologies, Sree Sai Aerotech |

| 3D Printing | LMW, L&T, SunFab |